COMMBANK DIGITAL PROJECTS

As an Experience Designer for Commonwealth Bank of Australia in Sydney. My role was to design a range of initiatives, across a number of channels and devices. My focus was on a range of projects in the area of mobile using hypothesis driven design thinking as well as cognitive bias to understand and solve core customer problems in the area of financial well-being.

Experience design for self-servicing initiatives within the Commbank app customers include:

Account Information: Proof of Balance

Update Contact details: Address and mobile number

Business Bankers Portal

CBA PROPERTY APP - Affordability & Property Search

How do you know if you can afford the home you love and know all the hidden costs before you start?

Why would I use a property app from a bank when there are high profile real estate competitors with a big audience?

I want my bank to disclose all costs in the home loan purchase journey

Increase home loan pre- approvals

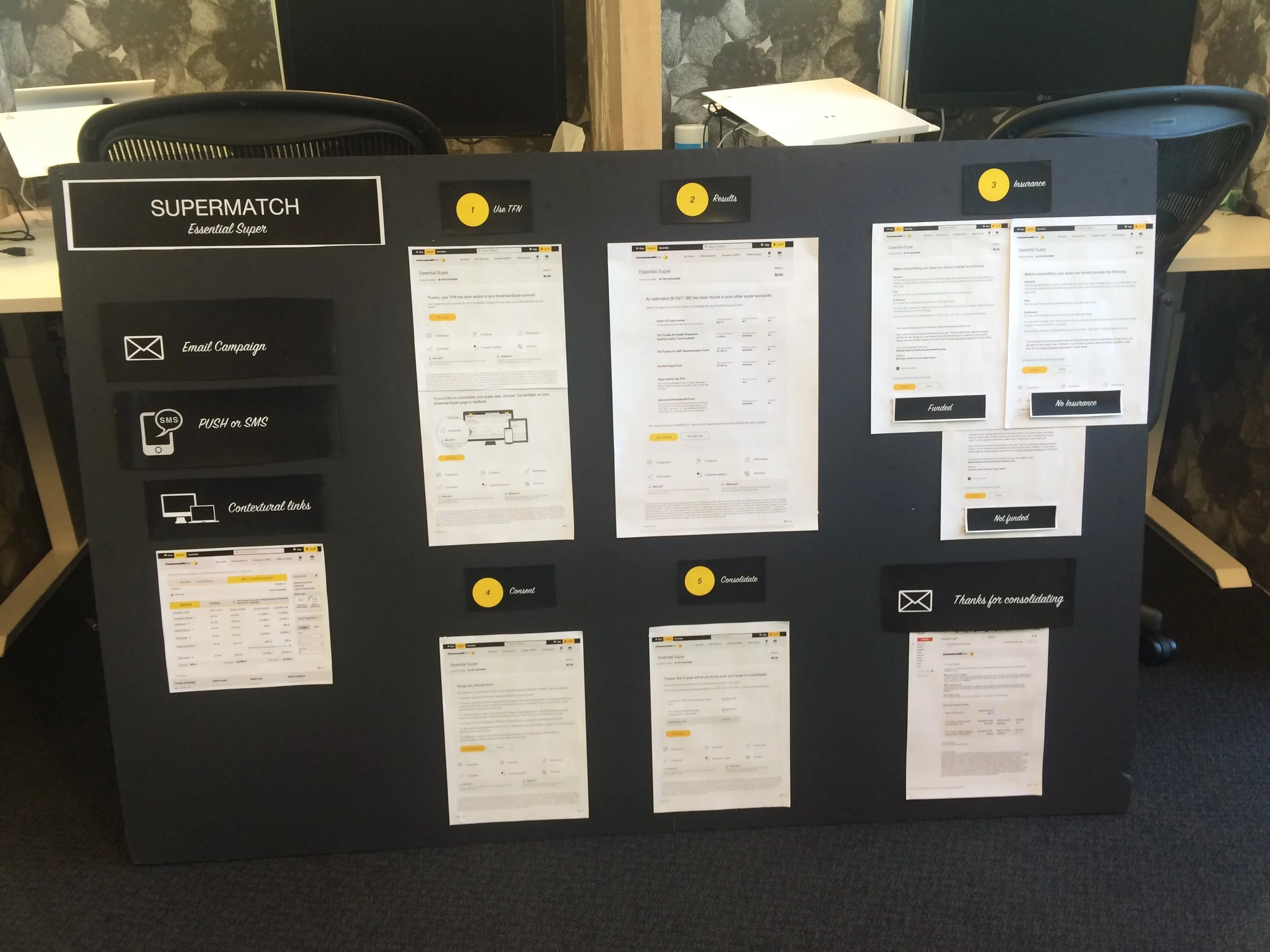

NETBANK & Commbank APP - Essential Super

Tired of logging in to different service providers to view your super and then another to see your banking?

Accessing my superannuation savings to date is difficult

Engagement and understanding of my super is too hard, I've put it in the "too hard basket"

I want to be able to see my super whenever I need to, makes sense it would be with my banking

COMMBANK APP - BETTER BILL EXPERIENCE

A staggering one third of Aussies have paid a bill late in the last 12 months according to new research by Commonwealth Bank

Managing and paying my bills, I have a work around but its cumbersome

I can't easily track and pay the myriad bills I have.

My credit rating is affected if I pay a bill late these days

I am concerned about missing bill payments and whether I have enough money to cover my bills

Using BPAY View is a poor expereinec

NETBANK & COMMBANK APP - TAX RESIDENCY DECLARATION

Governments now require all banks across Australia to check existing and new customers tax residency details as part of the the CRS legislation to combat tax evasion.

80% of customers are Australian tax residents

Anti-money laundering legislation requires all banks to collect these details from customers

How do you provide engagement on capturing a piece of information that has no customer benefit